Market Wrap-Up Today: Sensex Flat, Nifty Range-Bound | Wealth & Mutual Fund Insights

Market Wrap-Up

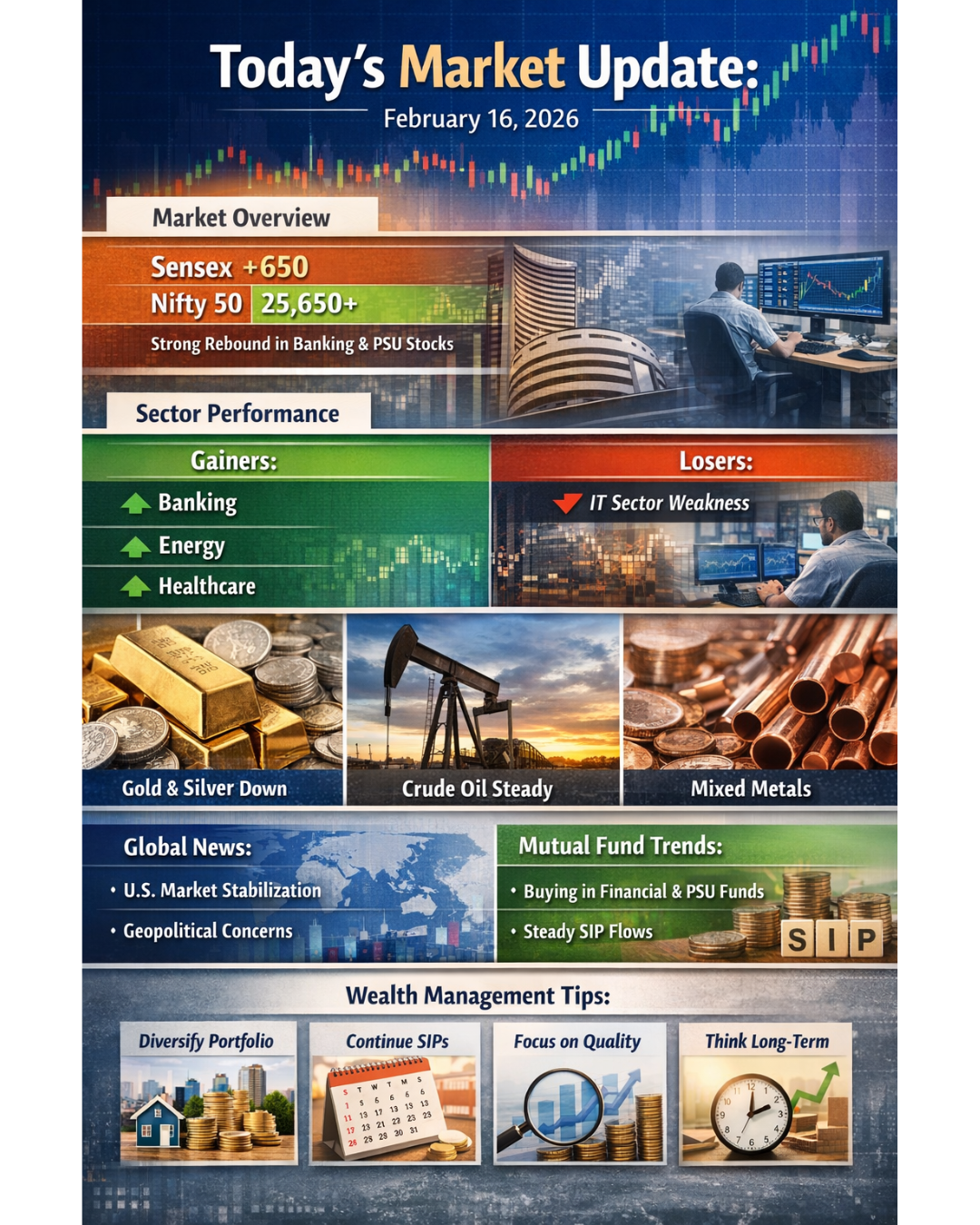

Indian equity markets ended the session on a cautious and range-bound note, reflecting mixed global cues and the absence of strong domestic triggers.

Today’s Market Numbers (Closing)

- Sensex: Closed around 84,600

- Nifty: Ended near 25,816

The markets traded in a narrow band throughout the day. Early weakness, driven by global risk-off sentiment, was partially offset by selective buying in financials and IT stocks, helping markets close largely flat with mild downside pressure. Broader indices remained muted, indicating cautious investor participation.

Today’s Important Market News

• Global cues remained weak, with Asian markets under pressure—especially in technology stocks—keeping risk appetite in check.

• Financial and IT sectors showed relative strength, preventing a deeper correction in benchmark indices.

• Regulatory updates for mutual funds around fee structures and disclosures supported long-term investor sentiment, particularly for SIP and long-term equity investors.

Outcome of Today’s Market

The session reflected consolidation near key levels, suggesting investors are waiting for fresh triggers such as global macro data, earnings cues, and fund flow clarity. Volatility remained controlled, but momentum was limited.

Wealth Management & Mutual Fund Perspective

In such sideways markets:

- Disciplined SIP investing continues to be effective for long-term wealth creation.

- Diversified mutual fund categories (Large Cap, Flexi Cap, Hybrid funds) help manage risk across market cycles.

- A structured wealth management approach focusing on asset allocation, periodic review, and rebalancing remains more important than short-term market timing.

Key Takeaway

Markets may remain volatile in the near term, but long-term fundamentals stay intact. Investors should stay focused on goals rather than daily noise.